Key events

Filters BETA

Ukraine: 12 grain ships leave ports

A dozen ships transporting grain have departed from Ukrainian ports today, despite Russia’s decision to renege on a deal struck in the summer, according to Ukraine’s minister of infrastructure, Oleksandr Kubrakov.

Russia’s decision to pull out of the deal after what it said was a “massive” drone attack against its Black Sea fleet sent wheat prices as much as 7.7% higher today.

Today 12 🚢s left 🇺🇦 ports. @UN & 🇹🇷delegations provide 10 inspection teams to inspect 40 🛳️s aiming to fulfill the #BlackSeaGrainInitiative. This inspection plan has been accepted by the 🇺🇦 delegation. The russian delegation has been informed.

— Oleksandr Kubrakov (@OlKubrakov) October 31, 2022

At the same time, the passage to 🇺🇦 ports for loading is allowed for 4 🚢s that have already passed inspection in the Bosphorus the day before. The inspection group was composed of representatives of the @UN, 🇹🇷, 🇺🇦 & russia.

— Oleksandr Kubrakov (@OlKubrakov) October 31, 2022

The IKARIA ANGEL 🚢 loaded w/ 40 K tons of grain is among the vessels that have left 🇺🇦 ports. This is the 7th 🛳️ chartered under the @UN @WFP. These foodstuffs were intended for the residents of Ethiopia, who faced the real possibility of mass starvation. pic.twitter.com/hy8nKcF168

— Oleksandr Kubrakov (@OlKubrakov) October 31, 2022

Today’s Bank of England data showed a shift away from credit card spending to higher saving (among those who can).

Karl Thompson, economist at the Centre for Economics and Business Research, said:

While soaring inflation has likely driven many households to resort to credit in order to finance essential spending, the latest figures suggest that rising interest rates have acted to disincentivise borrowing and drive higher savings, among those who can. Indeed, new savings reached their highest level in over a year in September.

Savings showed a notable uptick in September, with households depositing an additional £8.1bn with banks and building societies last month, up from £3.2bn in August and marking the highest figure since June 2021.

This likely reflects the notable increased incentive to save, for those who are able to, as saving rates have jumped. Meanwhile, the expected worsening of the cost-of-living crisis over the months to come will be leading to a rise in precautionary savings. With further monetary policy tightening expected over the coming months, the gap in borrowing and saving behaviour between households with different degrees of financial health is likely to widen further.

Just Stop Oil spray orange paint on Home Office, Bank of England

Members of the Just Stop Oil campaign group Just Stop Oil supporters have sprayed orange paint on four buildings in Central London, and are demanding that the government halts all new oil and gas licences and consents.

This morning, Just Stop Oil supporters sprayed orange paint from fire extinguishers on the Home Office, the MI5 building, The Bank of England and the headquarters of News Corp at London Bridge. The buildings were chosen to represent the pillars that support and maintain the power of the fossil fuel economy – government, security, finance and media, the group said.

A Just Stop Oil spokesperson said:

We are not prepared to stand by and watch while everything we love is destroyed, while vulnerable people go hungry and fossil fuel companies and the rich profit from our misery.

The era of fossil fuels should be long gone, but the creeping tentacles of fossil fuel interests continue to corrupt our politics, government and the media as they have for decades.

How else do you explain a government ignoring sensible no-brainer policies like renewables, insulation and public transport, which would cut our energy bills and our carbon emissions, in favour of corrupt schemes to drill for uneconomic oil and gas at taxpayers expense?

The group said it would continue to fight peacefully against the government’s plans to licence over 100 new oil and gas projects by 2025, and its failure to fulfil its promise to help people with their skyrocketing energy bills.

🎃 BREAKING: LONDON PAINTED ORANGE 🎃

🧯 At 8:30am today, 6 Just Stop Oil supporters sprayed orange paint from fire extinguishers onto the Home Office, the MI5 building, the Bank of England and the headquarters of News Corp at London Bridge.

🎥 @cameraZoe pic.twitter.com/YCgTzvokQO

— Just Stop Oil ⚖️💀🛢 (@JustStop_Oil) October 31, 2022

Britishvolt could enter administration today, with potential loss of 300 jobs

Jasper Jolly

Government-backed battery startup Britishvolt is considering entering administration with the potential loss of nearly 300 jobs after it struggled to find investors willing to fund its effort to build a giant £3.8bn “gigafactory” in north-east England.

The company could announce an administration as soon as Monday, with the accountancy firm EY lined up to carry it out if it goes ahead, two sources with knowledge of Britishvolt’s operations told the Guardian. However, one source cautioned that Britishvolt was also still examining other options.

A Britishvolt spokesperson said: “Company policy is to not comment on market speculation.”

Britishvolt was founded less than three years ago with the ambitious aim of building an enormous factory that would be able to supply batteries to carmakers. It quickly became a flagship project for the UK automotive industry, and gained the support of former prime minister Boris Johnson, who repeatedly cited the project as an example of Britain leading the way in moving away from fossil fuels.

The government eventually gave the company a promise of £100m in financial support, while the current prime minister, Rishi Sunak, was chancellor. However, the company has not yet received the money, which was earmarked for tooling within the factory which has not been bought.

Martin Beck, chief economic advisor to the EY ITEM Club, an leading economic forecaster, has looked at today’s mortgage data from the Bank of England.

Mortgage activity weakened in September after a surprise increase in activity in August. Approvals for home purchase were 66,789 in September, down from 74,422 in August and a little below the average of the year-to-date. Net lending held steady at £6.1bn in September.

The rise in swap rates following the mini-Budget caused a sizeable increase in quoted interest rates for fixed rate mortgages, meaning that house prices looked heavily overvalued based on mortgage affordability. Swap rates have since fallen back, with mortgage rates set to follow.

However, interest rates are likely to remain well above the levels seen in the first half of this year, and house prices will continue to look stretched. This is likely to cause new buyer demand to fall in the short-term. While the high share of fixed-rate mortgage deals will slow the pace at which borrowers have to face higher debt servicing costs – and so limit the extent of ‘forced’ sales – a correction in house prices still remains likely.

Net unsecured lending fell back to just £0.7bn in September, down from £1.2bn in October and a nine-month low. This was due to both another rise in the already-high level of repayments and a fall in gross lending. At the same time, the monthly increase in household deposits of £8.1bn was at a 15-month high.

The monthly data can be volatile and prone to revision. However, this combination is indicative of a household sector that is low on confidence and either unable, or unwilling, to borrow more and save less to try to push back against the squeeze on real incomes. The EY item Club thinks that with many mortgagors facing significant increases in their debt servicing costs in the next couple of years, they could begin to save more to try to absorb the higher payments.

Bert Colijn, senior eurozone economist at ING, has looked at the eurozone data, and the implications for monetary policy:

The eurozone contraction hasn’t started yet as GDP growth for the third quarter came in at 0.2%. Inflation continues to increase though, which sets the eurozone economy up for a tough winter as a recession is looming.

A positive surprise for eurozone GDP. In fairness, this has happened often during the pandemic recovery as the rebound effect has been stronger and lasted longer than expected. While cracks in the eurozone economy are clearly showing, the economy continued to expand in the third quarter. In Germany, it looks like this was mainly due to the last legs of the consumer rebound, while in France consumption growth had already stalled. Investment was the positive surprise in France. Spain experienced fast slowing growth but the tourism recovery prevented the economy from going into the red in the third quarter.

Overall, the picture remains bleak though. Consumer confidence is near historical lows as real wage growth is at a multiple-decade low at the moment…

The inflation rate jumped once again in October, to a whopping 10.7%. This was partly on higher consumer energy prices. The low prices on the wholesale market in recent weeks are clearly not yet translating into declining prices for households. In fact, it’s likely that this will only happen in a few months’ time and even that is a big ‘if’ because it depends on uncertain factors such as energy supply and the weather of course.

Turning to the outlook for eurozone borrowing costs, he said:

The slightly more dovish tone at the ECB press conference on Thursday indicates we shouldn’t come to expect such extensive rate hikes, such as the 75bp rise they gave us last week, to be a feature of forthcoming meetings, especially since a recession is drawing closer. Today’s data will provide more ammunition for the hawks to show that there is no need to make a sudden pivot yet. Overall though, we keep reiterating that current inflation cannot be fought effectively by monetary policy that has the most effect with a big lag. And hawks cannot expect GDP to keep surprising on the upside forever.

With economic conditions weakening and a recession in the making for the winter, we think the ECB is going make its next hike somewhat smaller at 50 basis points. Given the historic total size of the hikes the ECB is delivering, that will have quite the slowing impact on the economy next year.

Core inflation in the eurozone, which strips out volatile items such as food, alcohol and tobacco along with energy, picked up to 5% in October from 4.8%, as expected.

The European Central Bank has raised interest rates three times in recent months to combat high inflation. Last week, it lifted its key interest rate, the deposit rate, by 75 basis points to 1.5%.

Pledging to bring inflation back down to 2%, the ECB president, Christine Lagarde, said she was nevertheless concerned by a looming recession across the 19-member currency bloc, sending a strong signal that future rate rises would be muted.

Investors have been betting that the deposit rate, which governs the borrowing costs passed on by commercial banks, will peak at 3% next year as the German, Italian, French and Spanish economies contract.

Nicola Nobile and Paolo Grignani, economists at Oxford Economics, said:

Last Friday’s data at the national level showed price pressures intensifying in Germany, France and Italy, despite some moderation coming from Spain. What’s more, the divergence among inflation rates within eurozone countries is intensifying, making the matter worse for monetary policy.

Last Thursday the ECB, after a 75bps increase in rates, signalled that the pace of hikes could slow. This is in line with our baseline view, which sees a further 75bps rate hike between the end of this year and early 2023.

However, too many caveats remain, in particular with respect to the near-term inflation outlook. Indeed, the latest host of data showed an upside surprise in GDP growth rates in Q3 and higher-than-expected inflation in October that somehow reduce the likelihood of a quicker dovish pivot.

Eurozone grows 0.2% in third quarter

The eurozone grew by 0.2% in the third quarter from the previous quarter, according to Eurostat’s flash estimate. This compares with 0.8% growth in the second quarter.

This means the currency bloc has so far avoided a recession.

French and Spanish GDP increased by 0.2% over the quarter, while German GDP was up 0.3% and Italy grew by 0.5%.

Eurozone inflation jumps to record high of 10.7%

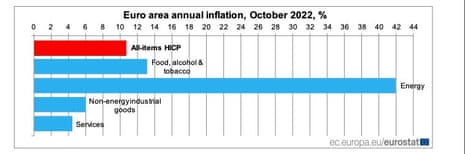

Euro area annual inflation has soared past forecasts to hit a fresh record high of 10.7% in October.

This is up from 9.9% in September, according to a flash estimate from Eurostat, the statistical office of the European Union. Economists had expected a more modest rise to 10.3%.

Energy costs soared to 41.9% from 40.7%, followed by food, alcohol and tobacco (13.1%, up from 11.8% in September), while industrial goods inflation picked up to 6% and services to 4.4%.

Turning to the rental market, and buy-to-let landlords, JLL said:

The current supply demand imbalance across the UK rental market looks set to endure as fewer households move across into owner occupation and demand for rental properties increases further.

We expect that prospective buyers, as well as those who would under normal circumstances have transacted under Help to Buy, will remain in the rental market. This adds further fuel to an already constrained rental market and will, we expect, mean the supply demand imbalance and resulting rental growth will continue. Rental growth is expected to be particularly strong at the front end of the five-year period before falling back in line with historic norms of circa 2% – 3% as inflation is brought back under control.

The outlook for investors is mixed. Demand for rental properties looks set to continue, and forecasts of rising rents and falling prices suggest we could see a rise in yields across the board. But the cost to service debt will remain a key issue for more highly indebted landlords.

JLL predicts 6% fall in UK house prices in 2023

The property firm JLL (Jones Lang LaSalle) is predicting a 6% fall in UK house prices next year, rather than a 20% to 30% crash as some other forecasters.

It said house price crashes have been rare in the UK.

On a regional level, JLL’s forecasts falls range from 4% across Greater London to around 8% in Wales, the North East and Yorkshire & the Humber.

The last 15 years have seen UK house prices reach new highs on the back of a period of record low borrowing costs. Never prior to 2008 had the UK base interest rate dipped below 2%. But in the period since the Global Financial Crisis (GFC) it has averaged 0.5% and hit a low of 0.1% during Covid.

However, events of the past year, and more so the past six weeks, have led to a growing set of predictions that a UK house price crash is now imminent. A spike in borrowing costs – and an anticipated further steep rise in mortgage rates – alongside continued high inflation, the cost-of-living crisis and an impending recession have prompted predictions from the most bearish forecasters of 20% to 30% fall in UK house prices. But these predictions fail to recognise that UK house prices have never fallen by more than 20%.

And this prompts a question of whether the underlying market prospects are truly worse than the two previous crashes – the early 90s recession where house prices fell 20% cumulatively between 1989 and 1993 and the GFC where prices fell by 15% between Jan 2008 and May 2009.

JLL pointed to an absence of distress, saying 62% of the UK’s 8.4m mortgaged owner occupier households have at least 25% equity in their house. Just 0.2% or circa 17,000 owner occupied households in the UK have less than 5% equity – and, statistically at least, there are no households with zero equity. Meanwhile, more than 95% of the 3m buy to let landlords who own with a mortgage, own at least 20% in their property.

An era of cheap borrowing is ending and mortgage affordability is about to become squeezed. However, mortgaged households in the UK have the highest incomes by tenure – averaging £80,000 per annum. Before the recent rise in UK interest rates, the average household income spent on a UK mortgage was equivalent to 18%.

With the average two-year fixed rate mortgage cost having risen to circa 6%, that income to mortgage expenditure percentage has risen to circa 27% – the level it was around the time of the Global Financial Crisis. And if mortgage rates hit 7%, the average household income to mortgage cost ratio would hit 30% – the rate it was in the early 1990s.

But merely spending 30% of a household income on housing costs is not a reason to assume a collapse into distress. With low unemployment and the highest average incomes, the UK’s mortgaged households have a more stable financial footing than the GFC or the early 1990s recession.

Ultimately, we expect that there will be far less distress in the market as there was in previous crashes – as long as there is no sharp rise in unemployment. But JLL predicts there will be a steep fall in UK housing transactions.

UK mortgage approvals drop 10%, credit card borrowing plunges

UK mortgage approvals fell by 10% last month and consumer credit also declined, as people borrowed less on their credit cards amid the cost of living crisis.

Bank of England figures show that mortgage approvals for house purchases decreased “significantly” to 66,800 in September from 74,400 in August, adding to other evidence that the housing market is slowing. Mortgage lending was unchanged at £6.1bn. The actual interest rate paid on newly drawn mortgages climbed by 29 basis points to 2.84%.

Consumers borrowed an additional £700m in consumer credit, down from £1.2bn in August, as credit card borrowing plunged to £100m from £700m. Other forms of credit include car dealership finance and personal loans.

UK government’s £400 energy bill support going unclaimed

Jasper Jolly

Government energy bill support worth as much as £400 over the winter is not reaching many households who use prepayment meters, according to data from a payments company.

Households with prepayment energy meters are entitled to vouchers giving them monthly discounts, but only half of the expected number have been used so far, according to PayPoint, which handles top-up payments in shops across the UK.

Discounts on energy bills were due to start on 1 October for everyone in the UK, regardless of the size of the household, with a reduction of £66 or £67 a month between October and March.

Energy companies will apply the discounts automatically to bills for households who pay via monthly bills, but users of many prepayment meters, who are generally poorer, must actively claim the discounts.

PayPoint had expected to process 800,000 vouchers in October, worth a total of £52.8m. However, the business said only £27m had been redeemed, according to figures first reported by BBC News.

UK clears Czech billionaire to raise Royal Mail stake beyond 25%

The UK government has cleared an investment vehicle controlled by a Czech billionaire, which is the largest shareholder in Royal Mail (now known as International Distribution Services), to raise its stake beyond 25%. Royal Mail recently changed its name.

Vesa Equity investment, controlled by Daniel Křetínský, held just over 22% of the 500-year-old postal firm in July, and ministers conducted a national security review into its ownership in August. Today, the postal firm said in a statement to the London stock exchange:

On 25 August 2022, the company announced (whilst still named Royal Mail plc) that it had received notification from the Secretary of State for Business, Energy and Industrial Strategy that he reasonably suspected that arrangements were in progress or contemplation which, if carried into effect, would result in Vesa increasing its shareholding in the company from 25% or less to more than 25% and that he was exercising his call-in power under section 1 of the NSI [National Security and Investment] Act.

The company has now been notified by the Secretary of State that no further action is to be taken under the NSI Act in relation to the potential increase by Vesa of its shareholding in the company to more than 25%.

Křetínský’s financial holdings also include Sainsbury’s and West Ham United. The billionaire, known as the “Czech sphinx” for his low public profile, has not commented in detail on his intentions for Royal Mail since he became its largest shareholder in 2020.

His move to increase his stake will trigger speculation that he is aiming for a full takeover of the group.

This could be problematic, however, given the tycoon’s links to the Russian state gas operator, Gazprom. The businessman also owns Sparta Prague football club, and is estimated to be worth about £3bn. His girlfriend is the champion show jumper Anna Kellnerová, 25, the daughter of the late Czech businessman Petr Kellner, who was once the country’s richest person.

UK energy price caps will help reduce inflation, says ONS

Britain’s energy price cap for consumers, and government-funded discounts to help small businesses pay their energy bills, will push inflation lower, the Office for National Statistics said today.

The price cuts – introduced after Russia’s invasion of Ukraine sent energy costs spiralling – are expected to lower various measures of inflation, thereby reducing debt interest costs for the government from inflation-linked bonds.

The ONS said payments under the energy price guarantee (EPG) for households and the energy bill relief scheme for businesses (EBRS) will be classified as subsidies on products, paid by central government to energy suppliers.

This means that reduced unit prices for gas and electricity will be used to compile the consumer prices index, “which will hence be lower while the schemes are in operation than if the EPG had not been introduced”.

The lower unit energy prices for businesses will affect the input producer price index, which measures the cost of raw materials used in production, and “which will hence be lower than if the EBRS had not been introduced”.

Annual consumer price inflation returned to a 40-year high of 10.1% in September and the Bank of England expects it will peak at just below 11% this month.

In August, the ONS ruled that £400 energy bill rebates for consumers could not be viewed as lowering inflation because they represented an increase in household income rather than a cut in household spending, which the CPI is based on.

The ONS explained:

Under the EPG and the EBRS, the government specifies either a limit on the amount that consumers can be charged for a unit of gas or electricity, or a price reduction to be applied per unit of gas and electricity consumed. The government fully compensates energy suppliers for the savings delivered to domestic and non-domestic consumers. These payments will apply for six months beginning on 1 October 2022.

The ONS has classified payments under the Energy Price Guarantee and the Energy Bill Relief Scheme as subsidies on products.

As such, these schemes will impact our inflation statistics.

Please read our statement ➡️ https://t.co/EtEUqmxaab

— Office for National Statistics (ONS) (@ONS) October 31, 2022

Bank stocks rise after report UK unlikely to impose windfall tax

Shares in NatWest, Lloyds Banking Group and Barclays have risen after the Sunday Times reported that government sources poured cold water on the idea of a windfall tax on banks to plug a big hole in the government finances. The paper said:

The government last night quashed suggestions that it is considering a windfall tax on banks as one of the measures to plug a hole in its finances at next month’s budget.

Two senior sources close to prime minister Rishi Sunak and chancellor Jeremy Hunt played down the idea that they were looking at ways to impose additional taxes on banks. The news will come as a relief to the City, which had feared a raid on bumper profits derived from rises in interest rates.

The FTSE 350 banking index gained 1.1% in early trading. NatWest, Lloyds and Barclays were among the biggest risers on the FTSE 100, up 3.8%, 2.1% and 1.3% respectively while the insurer Prudential also rose 1.3%.

The overall FTSE 100 slipped 8 points, or 0.1%, to 7,039. The German, French and Italian markets were also flat to slightly lower.

Introduction: Wheat prices soar; eurozone inflation expected to hit new record

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

Wheat and corn futures soared on world markets after Russia pulled out of a deal to allow grain exports from Ukraine through the Black Sea, which is seen as vital for world supplies and bringing high global food costs down.

Russia suspended the agreement on Saturday after what it called a “massive” drone attack on its Black Sea Fleet in Sevastopol, Crimea, saying it could not guarantee the safety of civilian cargo ships participating in the ‘Black Sea Initiative’.

The International Rescue Committee warned of the “catastrophic consequences of Russia suspending its participation” in a deal that was thrashed out in Istanbul this summer.

The most-traded wheat contract on the Chicago Board of Trade jumped as much as 7.7% to $8.93 a bushel at the open on Monday, the highest since 14 October, and later traded at $8.79.

Corn prices rose as much as 2.8% to $7 a bushel and soybean oil gained 3%.

Russia’s move threatens to push global food prices even higher and to exacerbate the world food crisis. The United Nations, Nato, European Union and US have all urged Russia to reverse its decision to pull out of the grain deal.

Data out later this morning is expected to show eurozone inflation hitting a new record high of 10.3% in September, in part because of higher food prices. We already know that inflation in Germany climbed to 11.6% last month. Core prices in the eurozone are also expected to rise, from 4.8% to 5%.

Michael Hewson, chief market analyst at CMC Markets UK, said:

While US inflation appears to be showing signs of slowing, the same can’t be said for inflation in Europe which appears to be continuing to rise, after last week’s hot German inflation numbers for October…

This is the nightmare scenario for the ECB, as the pressure to hike further will only increase at the same time as the economy continues to slow.

In China, business surveys pointed to a weaker economy in October. The official manufacturing PMI survey showed a contraction in factory activity in October (49.2), compared with September’s modest expansion (50.1). Any reading above 50 indicates expansion; any reading below contraction.

The non-manufacturing PMI index also recorded a contraction, falling to 48.7 in October, from 50.6 in September a month ago. It was dragged lower by real estate and construction, but adding to the gloom, the retail sector was also weaker, even though the first week of October was the Golden Week holidays.

Iris Pang, chief economist Greater China at ING, said:

For the manufacturing PMI, almost every sub-index fell from last month’s reading. The exception to this was for raw material prices, which means even thinner profit margins for manufacturers. New orders were weaker, hinting at a further fall in activity levels in the coming months. New export orders remained in contraction, but slightly less so than last month. That makes it very hard to be optimistic about either manufacturing or exports for November and December.

All in all, October looks to have been a weak month for the economy, and November looks as if it will be no better than October. Compounding this is the fact that Covid cases are climbing again, and it is possible that we will see further small-scale lockdowns in China. We also expect a contraction in export demand in the coming months reflecting the weakening external environment.

Asian stocks mostly rose, with Japan’s Nikkei closing 1.8% higher and the Australian market rising 1.2%. China’s Shanghai composite fell 0.8% and Hong Kong’s Hang Seng dropped almost 1%, however. European markets are expected to open slightly higher.

The Agenda

-

9am BST: Italy GDP flash for third quarter (forecast: 2%, previous: 5%)

-

9.30am BST: UK Bank of England mortgage approvals and consumer credit for September

-

10am BST: Eurozone inflation flash for October (forecast: 10.3%)

-

10am BST: Eurozone GDP flash for Q3 (forecast: 0.2%, previous: 0.8%)

This article is first published on Source link