United States Steel Corporation X reported earnings of $490 million, or $1.85 per share, in the third quarter of 2022, compared with earnings of $2,002 million, or $6.97 per share, in the year-ago quarter.

Excluding one-time items, adjusted earnings per share were $1.95 per share. The number beat the Zacks Consensus Estimate of $1.92.

Revenue fell about 13% year over year to $5,203 million in the reported quarter. However, it beat the Zacks Consensus Estimate of $4,913.9 million.

The company witnessed a sharp decline in demand during the quarter. The Mini Mill and US Steel Europe segments also faced the problem of higher raw material prices. Higher energy costs also impacted the US Steel Europe division. The company’s profit in the reporting quarter was also affected by lower prices in the Flat-Ralled, Mini Mill and US Steel Europe segments.

The company’s total shipments were down about 10% year-over-year to 3,698,000 tons.

United States Steel Corporation Price, Consensus and Earnings Per Share Surprise

United States Steel Corporation price-consensus-eps-surprise-chart | Quote from United States Steel Corporation

Highlights of the segment

Flat roll: The segment posted revenue of $505 million in the reported quarter, down about 50% year-over-year.

Steel shipments in this segment fell by about 7% year-on-year to 2,176,000 tons. The average realized price per ton per unit was $1,232, down approximately 7% year over year.

Mini mill: The segment posted revenue of $1 million in the quarter, down from $424 million in the year-ago quarter. Shipments totaled 529,000 tons, down about 13% year-on-year. The average realized price per ton was $1,096, down approximately 28% year-over-year.

US Steel Europe: The segment had a loss of $32 million, compared with a profit of $394 million in the year-ago quarter. Deliveries in this segment were down about 19% year-over-year to 867,000 tons. The average realized price per ton of the unit was $1,021, down approximately 11% year-over-year.

tubular: The segment generated revenue of $155 million in the reported quarter. Shipments rose about 2% year-on-year to 126,000 tons. The average realized price per ton of the unit was $3,217, an increase of approximately 89% compared to last year.

Finances

At the end of the quarter, the company’s cash and cash equivalents totaled $3,364 million, an increase of approximately 65% year-over-year. Long-term debt decreased approximately 10% year-over-year to $3,863 million.

Prospects

US Steel said it continues to focus on the Mini Mill’s ability to supply metals as a competitive cost advantage as it runs with more expensive feedstocks until the end of this year. The company also expects energy costs at US Steel Europe to remain high. It also expects approximately 40% of its strategic investments to be completed by the end of the year.

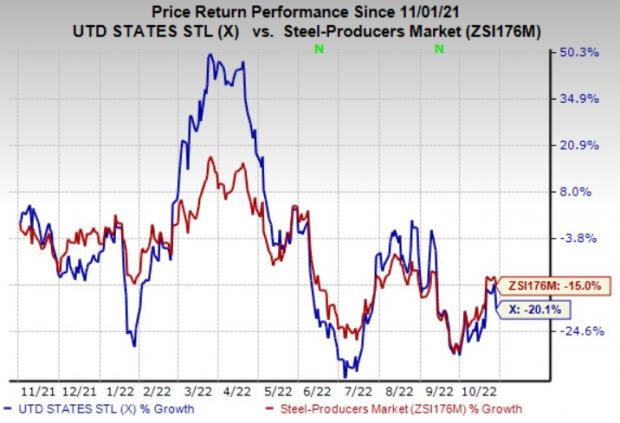

Price Performance

Over the past year, the company’s shares fell by 20.1% compared to last year. industryA 15% reduction.

Image source: Zacks Investment Research

Zacks Rank and Key Picks

US Steel currently has a Zacks Rank #4 (Sell).

Top rated stocks to consider in the basic materials space include Albemarle Corporation ALB, Sociedad Kimica and Minera de Chile S.A KVM and Ryerson Holding Corporation RYI.

Albemarle, currently a Zacks Rank #1 (Strong Buy), has a projected earnings growth rate of 430.7% for the current year. The Zacks Consensus Estimate for ALB’s current year earnings has been revised upward by 5.8% over the past 60 days. You see a complete list of today’s Zacks #1 Rank stocks here.

Albemarle’s earnings have topped the Zacks Consensus Estimate in each of the last four quarters. Profits over the past four quarters have averaged approximately 24.2%. ALB has gained about 12% for the year.

Sociedad forecasts profit growth of 530.7% this year. The Zacks Consensus Estimate for SQM’s current year earnings has been revised upward by 2.1% over the past 60 days.

Sociedad’s earnings for the last four quarters were unexpectedly around 27.2%. SQM is up about 67% year over year. The company currently has a Zacks Rank #1.

Currently a Zacks Rank #1, Ryerson Holding has an expected earnings growth rate of 74.2% for the current year. The consensus estimate for RYI’s current year earnings has been revised 3.2% to the upside over the past 60 days.

Ryerson Holding’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, by an average of 28.9%. RYI is up about 23% year over year.

7 best promotions for the next 30 days

Just released: Experts highlight 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They consider these tickers “likely to be early prices.”

Since 1988, the full list has outperformed the market by more than 2 times with an average increase of +24.8% per year. Therefore, do not forget to immediately pay attention to these 7 selected specimens. See them now >>

United States Steel Corporation (X): Free Stock Analysis Report

Albemarle Corporation (ALB): Free Stock Analysis Report

Sociedad Quimica y Minera SA (SQM): Free Stock Analysis Report

Ryerson Holding Corporation (RYI): Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

This article is first published on Source link